Financial commitment cash may be used to qualify for any mortgage. But lenders very likely gained’t count the full asset total. When retirement accounts consist of stocks, bonds, or mutual funds, lenders can only use 70% of the value of those accounts to ascertain the quantity of distributions stay.

It’s also important to assessment borrower necessities, such as time in enterprise, profits minimums, and credit rating score thresholds. Some lenders accommodate firms with constrained credit score history, while others desire extra proven profiles.

This might develop into burdensome, specifically in an adverse monetary or overall health-linked circumstance. Also, there isn't any promise of finding a lender to provide you with a good fascination amount.

Not merely any individual may get a HECM loan. Because the federal federal government backs the loan, both you and your existing home have to fulfill a set of specifications.

You and/or an suitable husband or wife — who need to be named therefore on the loan even though he or she is just not a co-borrower — Reside in the house as your Key residence

Explore additional individual loan resourcesPre-qualify for a private loanCompare best lendersPersonal loan reviewsPersonal loan calculatorHow to qualifyHow to consolidate charge card debtAverage own loan curiosity charges

Supplementing fixed profits: An increasing number of senior citizens are getting it difficult to Stay on their preset incomes. Retirees may decide to market or refinance their properties, finance a brand new home buy, and utilize the fairness cashed out to nutritional supplement their income

There are fees associated. Though you receive payments by using a reverse property finance loan, it's not free of charge. Together with residence taxes, routine maintenance, as well as other expenditures, you could have to pay for closing charges and servicing expenses around the class of the loan.

Agree to set apart many of your reverse home finance loan resources at closing—or display that you've plenty of savings—to buy ongoing click here expenses connected to your private home.

Similar to a HELOC, dwelling fairness loans use your home's fairness as collateral but function far more like a standard loan with fixed payments over a established expression.

What's a HECM reverse property finance loan? A HECM reverse house loan can be a loan solely available to homeowners sixty two+ that converts a part of home fairness into usable income without having expected regular house loan payments.* Learn More *The borrower must satisfy all loan obligations, which includes residing in the assets as being the principal residence, protecting the home, and paying home charges, including residence taxes, costs, hazard insurance coverage. Should the homeowner isn't going to meet these loan obligations, then the loan will must be repaid.

Navigating the housing market could be intricate, Primarily With regards to mortgages for seniors on Social Safety. Even so, various mortgage options are available which can be tailor-made to accommodate the monetary realities of Social Stability recipients.

Physical issues: Cleaning and repairs can become bodily taxing. Many seniors purchase a new property to reduce repairs

Very first to become voted on was a Invoice which include laws on border security, which failed, as expected. A lot of rightwing Republicans will not want the Biden administration to earn credit for resolving a crisis in the US border with Mexico, in which There have been an upsurge of asylum seekers, throughout an election yr.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Melissa Joan Hart Then & Now!

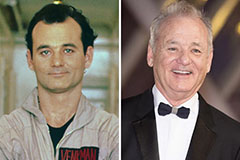

Melissa Joan Hart Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!